Assignment 8

Objective and Overview

Objective: Practice using Pandas to work with time-series data and investment returns.

Overview: In this assignment, you will implement some functions to to help quantify the risk of an investment strategy. In particular, you will implement computations of two risk metrics: the value at risk and the drawdown of an investment.

Preliminaries

In your work on this assignment, make sure to abide by the collaboration policies of the course.

For each problem in this problem set, we will be writing or evaluating some Python code. You are encouraged to use the Spyder IDE which will be discussed/presented in class, but you are welcome to use another IDE if you choose.

If you have questions while working on this assignment, please post them on Piazza! This is the best way to get a quick response from your classmates and the course staff.

Important Guidelines: Comments and Docstrings

-

Refer to the class Coding Standards for important style guidelines. The grader will be awarding/deducting points for writing code that comforms to these standards.

-

Every program file must begin with a descriptive header comment that includes your name, username/BU email, and a brief description of the work contained in the file.

-

Every function must include a descriptive docstring that explains what the function does and identifies/defines each of the parameters to the function.

NumPy Programming Toolkit

This assignment will require the (free) NumPy toolkit of numeric programming tools.

If you are using Anaconda/Spyder, this package is already installed for you.

If you are not using Spyder, you will need to install it yourself. The easiest way

to install this is by running the pip command at the shell (i.e., the Terminal on Mac).

pip3 install numpy scipy matplotlib pandas

For alternative installation instructions, see: https://scipy.org/install.html

Task 1: Quantifying Investment Risk, Part 1: Value at Risk

50 points; individual-only

Value at Risk is a measure of how much (in dollars or percentage) we expect an investment to lose if a very bad series of events occurs over a given time horizon. For example, if things go really badly, how much would we lose in 10 days?

There are many methods to calculate the value at risk, but a common approach is to assume approximately normally distributed investment returns and to construct a confidence level about how bad a loss we might sustain over a given time horizon.

Do this entire task in a file called a8task1.py.

-

Write a function

compute_model_var_pct(mu, sigma, x, n)to compute the value at risk as a percentage of the asset/portfolio value.The function must return the value at risk as a floating point number.

This version of the Value at Risk estimate will use a model of the asset’s returns, assuming a normal distribution of daily returns, described by the parameters

mu(the mean daily rate of return) andsigma(the daily standard deviation of returns).

The function parameters

xandnare used to calibrate the estimate of VaR for the confidence level that the maximum loss during the number of days will not be exceeded. In words, we want to bexpercent confident of our maximum (percentage) loss over the course ofnconsecutive days.Here is an example of using this function call:

# estimate the 10-day VaR (98% confidence) # using a mean daily return of 0.0008 and standard deviaton of 0.01 >>> compute_model_var_pct(0.0008, 0.01, 0.98, 10) -0.05694524299686158 # estimate the 14-day VaR (97% confidence) # using a mean daily return of 0.001 and standard deviaton of 0.015 >>> compute_model_var_pct(0.001, 0.015, 0.97, 14) -0.09155927945404512

Note: the value

Zis a quantity of standard deviations corresponding to the confidence level. Use the functionscipy.stats.norm.ppf(p), wherepcorresponds to the probability of an event outside the confidence level, e.g.p = 1 - x. -

Write the

compute_historical_var_pct(returns, x, n), to compute the VaR (as a percentage) using the historical simulation approach.The function must return the value at risk as a floating point number.

The parameter

returnsis a Pandas Series containing historical daily stock returns, with a date index.The function parameters

xandnare used to calibrate the estimate of VaR for the confidence level that the maximum loss during the number of days will not be exceeded. In words, we want to bexpercent confident of our maximum (percentage) loss over the course ofnconsecutive days.Procedure

In this function, we must begin by sorting the daily returns. Use the confidence level

xto find thenth worst day’s return.For example, suppose we have 500 daily returns and we need the 99% confidence level. We will use the rate of return from the 495th worst day, which will exclude the worst outliers. This is our one-day value at risk at the 99% confidence level.

For a multi-day VaR calculation, we need to scale this value by the time horizon, i.e.:

Example 1: Here is some example program output using data from the

SPYexchange-traded fund, using 1000 daily returns:count 1001.000000 mean 0.000370 std 0.011934 min -0.115887 25% -0.002503 50% 0.000554 75% 0.004663 max 0.086731 Name: r, dtype: float64 With compute_historical_var_pct estimate, we are 98% confident that the maximum loss over 7 days would not exceed -7.69%.

Example 2: Here is some example program output using data from the

SPYexchange-traded fund, using 500 daily returns:count 501.000000 mean 0.000153 std 0.015369 min -0.115887 25% -0.003538 50% 0.000599 75% 0.005502 max 0.086731 Name: r, dtype: float64 With the compute_historical_var_pct estimate, we are 99% confident that the maximum loss over 10 days would not exceed -14.56%.

Note that the choice of the historical data set has a substantial impact on which data values are used for the

nth worst day. Your results might not match these exact values (depending on the data set you use), but they should be close.

Task 2: Quantifying Investment Risk, Part 2: Drawdown

50 points; individual-only

Drawdown is a measure of the loss of value from the most recent maximum value until today. Investors are concerned about the worst-case scenario, and drawdown helps to quantify this worst-case.

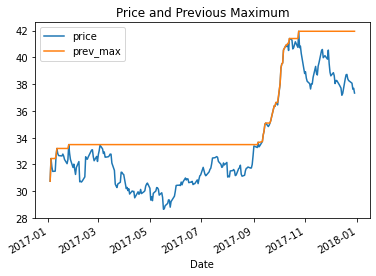

For example, here is a chart showing the daily price history (blue line) for GM shares for the calendar year 2017, as well as the previous maximum price (orange line):

An investor who remembers the “high price” of the stock on 2017-10-24, will feel that

they have lost value since that price ($41.95). The “drawdown” as of 2017-12-29 is

$4.62, i.e., a loss of about 12% from that previous maximum.

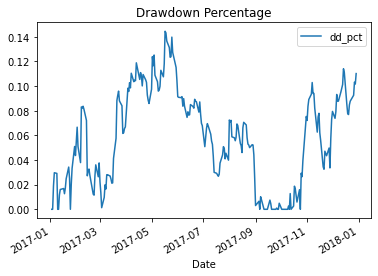

Here is another graph of the same time frame, showing the drawdown in percentage terms:

Do this entire task in a file called a8task2.py.

-

Write the function

compute_drawdown(prices), which processes a column of asset prices. The parameterpricescould be anp.arrayobject (or subclass, e.g., apandas.Seriesorpandas.DataFrame) containing a column array (n x 1) of asset prices, which we assume to be sequential (i.e. daily).The function returns a

pandas.DataFrameobject containing these columns:

price, which is a copy of the data in the parameterprices

prev_max, which contains the previous peak price before this price,

dd_dollars, which is the drawdown since the previous maximum price, measured in dollars,

dd_pct, which is the percentage decline since the previous maximum priceHere is an example of using this function, as well as the last several rows that it produces:

>>> df = pd.read_csv('/Users/azs/Downloads/GM.csv') >>> # set the 'Date' column as index >>> df.index = pd.to_datetime(df['Date']) >>> prices = pd.DataFrame(df.loc['2017-01-01':'2017-12-31','Adj Close']) >>> # compute drawdown for this one stock >>> dd = compute_drawdown(prices) >>> dd.describe() price prev_max dd_dollars dd_pct count 251.000000 251.000000 251.000000 251.000000 mean 33.544823 35.603981 2.059158 0.057907 std 3.635670 3.558961 1.384220 0.038419 min 28.647619 30.745390 0.000000 0.000000 25% 30.741016 33.483166 0.859024 0.025709 50% 32.214863 33.483166 2.078591 0.058816 75% 36.899145 37.336340 3.217404 0.088337 max 41.953167 41.953167 4.835547 0.144417 >>> dd.tail(10) price prev_max dd_dollars dd_pct Date 2017-12-15 37.298019 41.953167 4.655148 0.110961 2017-12-18 38.390999 41.953167 3.562168 0.084908 2017-12-19 38.700676 41.953167 3.252491 0.077527 2017-12-20 38.728004 41.953167 3.225163 0.076875 2017-12-21 38.400105 41.953167 3.553062 0.084691 2017-12-22 38.272587 41.953167 3.680580 0.087731 2017-12-26 38.072212 41.953167 3.880955 0.092507 2017-12-27 37.625912 41.953167 4.327255 0.103145 2017-12-28 37.689667 41.953167 4.263500 0.101625 2017-12-29 37.334450 41.953167 4.618717 0.110092 -

Write the function

plot_drawdown(df), which will create and show two charts:1 - The historical price and previous maximum price.

2 - The drawdown since previous maximum price as a percentage lost.

The parameter

df, is apandas.DataFrameobject containing these columns:

price, which is a copy of the data in the parameterprices

prev_max, which contains the previous peak price before this price

dd_dollars, which is the drawdown since the previous maximum price, measured in dollars

dd_pct, which is the percentage decline since the previous maximum price(i.e., the same data as the results from the function

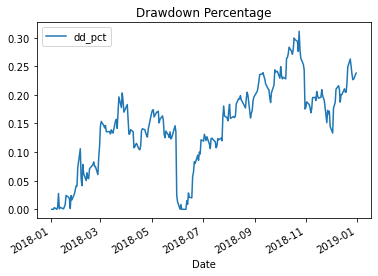

compute_drawdown(prices)).Here is an example of using this function:

>>> df = pd.read_csv('/Users/azs/Downloads/GM.csv') >>> # set the 'Date' column as index >>> df.index = pd.to_datetime(df['Date']) >>> prices = pd.DataFrame(df.loc['2008-01-01':'2008-12-31','Adj Close']) >>> # compute drawdown for this one stock >>> dd = compute_drawdown(prices) >>> plot_drawdown(dd)The above example produces these graphs:

-

Write the function

run_mc_drawdown_trials(init_price, years, r, sigma, trial_size, num_trials). This function will use the Monte Carlo stock simulation that you wrote in Assignment 7 to simulate the price path evoluation of a stock. Specifically, you will create an instance of theMCStockSimulatorclass, and runnum_trials, and calculate the maximum drawdown from each trial.The parameters are:

init_price: the initial stock price at time 0 of the simulation,

years: the number of years the simulation should run

r: the mean annual rate of return,

sigma: the standard deviation of annual returns,

trial_size: the number of discrete steps per year, i.e., number of trading days,

num_trials: the number of trials to include in this simulation run.The function returns a

pd.Seriesobject of the trial results (maximum drawdown of each trial).To begin, you must add this

importstatement at the top of your file:from a7task1 import MCStockSimulator

Here is a sample of calling this function. Note that with 100 trials of 2520 periods, this took several minutes to complete. You should begin your testing with smaller numbers, e.g., 10 trials of 12 periods, and check that everything works before increasing the running time requirements.

>>> # Using historical AAPL prices >>> # Using historical AAPL prices >>> df = pd.read_csv('/Users/azs/Downloads/AAPL.csv') >>> df['ret'] = np.log(df['Adj Close'] / df['Adj Close'].shift(1)) >>> trial_size = 252 # trading days/year >>> init_price = float(df['Adj Close'].sample()) >>> r = df['ret'].mean() * trial_size >>> sigma = df['ret'].std() * np.sqrt(trial_size) >>> years = 10 >>> num_trials = 100 >>> max_dd = run_mc_drawdown_trials(init_price, years, r, sigma, trial_size, num_trials) >>> max_dd.describe() count 100.000000 mean 0.489571 std 0.094382 min 0.321985 25% 0.423104 50% 0.482001 75% 0.543692 max 0.740162 dtype: float64 >>> max_dd.hist()The above example produces this chart:

In this graph, the possible drawdown (loss) is on the horizontal axis, and the veritcal axis shows the percentage of all trials with that degree of loss.

Notes:

-

Create a new

np.arrayto hold the results of the trials. After collecting the result, create and return apd.Seriesobject with these results. -

Use an accumulator pattern to execute

num_trialstrials, and to caclulate the maximum drawdown for each trial.

-

Take a screen shot of your graphs!

The Gradescope autograder cannot display/test your graphs. Instead, we will attempt to run your code manually to test the graphing.

As a backup, please take screen shots of your graphs and save as a single .pdf

file called a12graphs.pdf and attach this file to Gradescope.

To take a screen shot:

-

On Mac: use the keyboard sequence

Command-Shift-4, and then drag the cross-hairs to include the region you want to include. The image will be saved to your desktop. Create a Word document and drag your images into the document, then save as.pdf. -

On Windows: use the

Snipping Toolto create a screen shot for the desired area. Create a Word document and paste your images into the document, then save as.pdf.

Submitting Your Work

20 points; will be assigned by code review

Use the link to GradeScope (left) to submit your work.

Be sure to name your files correctly!

Under the heading for Assignment 8, attach these 4 required files:

a7task1.py,a8task1.py,a8task2.pyanda8graphs.pdf`.

In addition, please upload all .csv data files used by your program.

Notes:

- You may resubmit multiple times, but only the last submission will be graded.